Check after taxes

Some deductions from your paycheck are made. They can either be taxed at your regular rate.

Paycheck Taxes Federal State Local Withholding H R Block

This means that after tax you will take home 2573 every month or 594 per week.

. 21 hours agoThe income limits are based on your adjusted gross income AGI in either the 2020 or 2021 tax year. It can also be used to help fill steps 3 and 4 of a W-4 form. How to calculate annual income.

The most convenient way to check on a tax refund is by using the Wheres My Refund. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. Free salary hourly and more paycheck calculators.

Money you contribute to a 401k is pre-tax which means the contributions come out of your paycheck before income taxes are removed. Viewing your IRS account information. This number is the gross pay per pay period.

The state tax year is also 12 months but it differs from state to state. People who earned less than 125000 annually or 250000 if filing. Basic rate tax payers pay 20 on earnings over 12570 while higher rate payers are charged.

Using the IRS Wheres My Refund tool. A financial advisor in Pennsylvania can help you understand how taxes fit into your overall financial goals. Federal Salary Paycheck Calculator.

The federal tax rate for supplemental wages depends on whether your employer rolls them in with your regular wages or disburses them separately. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work.

That means that your net pay will be 43041 per year or 3587 per month. If your salary is 40000 then after tax and national insurance you will be left with 30879. Washington state does not impose a state income tax.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. IRS Tax Tip 2021-70 May 19 2021. Financial advisors can also help with investing and financial planning -.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Overview of New York Taxes. Subtract any deductions and.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Will display the status of your refund usually on the most recent tax year refund we have on file for you. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Taxpayers can start checking their. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. After months of anticipation Californians will soon be receiving the Middle Class Tax Refund also called inflation relief payments by. Get an accurate picture of the employees gross pay.

Check My Refund Status. But the tax bands were frozen by former Chancellor Rishi Sunak in 2021 until 2026. Your average tax rate is.

Sep 21 2022 1126 AM PDT. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Some states follow the federal tax.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The advantage of pre-tax contributions is that.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Your employer withholds a 62 Social Security tax and a. For example if an employee earns 1500.

The Difference Between Gross And Net Pay Economics Help

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

What Are Payroll Deductions Article

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2

Town Of Watertown Tax Bills Search Pay

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

7 Paycheck Laws Your Boss Could Be Breaking Fortune

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Pay Stub Meaning What To Include On An Employee Pay Stub

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Create Pay Stubs Instantly Generate Check Stubs Form Pros

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

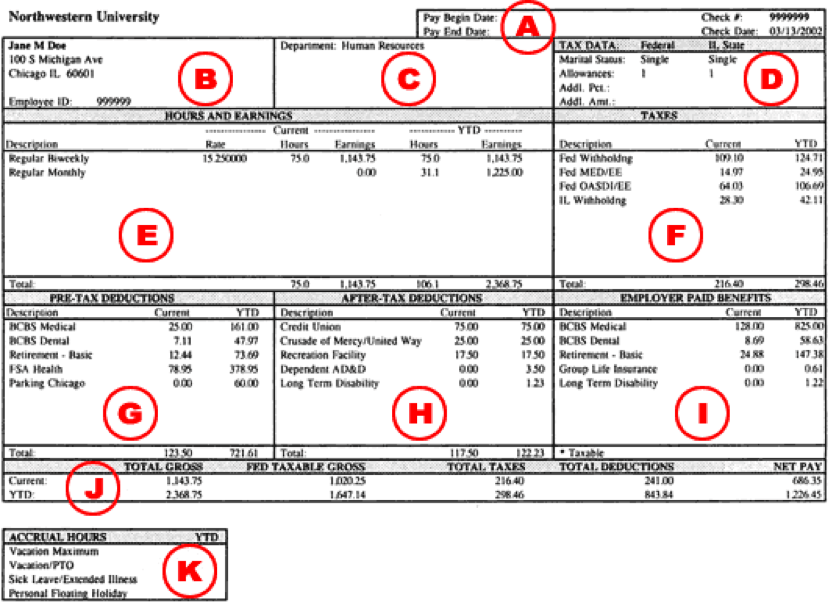

Understanding Your Paycheck Human Resources Northwestern University